How To Be Ready For Tax Time Next Year

Would you like to know how to be ready for tax time next year? If you set up a filing system now, you will be ready every year before tax time rolls around again. We all know the items the IRS is usually looking for, right?

I have to have everything organized, whether it’s my house, garage, closets, cupboards, or tax stuff. It’s who I am. I’m not a tax professional or giving you tax advice here today, I just want to share some of my tax organizational tips. If you have tax questions, you really should consult a CPA or tax attorney. So let’s get started.

Ready For Tax Time

I’m not sure how you feel, but tax time each spring is one of my least favorite times of the year. It’s not just the tax that has to be paid, it’s the challenge of gathering all the tax-related materials I’ll need so the tax forms are complete and accurate when sent in. Years ago my husband and I decided we needed to have a system in place so the effort is less time-consuming and as accurate as possible.

The first step was to identify and list the items that would be needed. We then put together a series of file folders for each type of receipt or form that would be needed. We all know the usual stuff like the W-2’s for payroll information, 1099’s for interest earned and MISC income generated, 1098 forms for interest paid on home mortgages, etc.

From these examples, we’re reminded that both income and some types of deductible expenses will need to be considered as part of the final tax calculations. There are other issues that may need to be addressed too, like voluntary contributions to the charity of your choice, property taxes paid relating to your home and/or cars, certain education expenses, withdrawals from an IRA or other retirement accounts, etc.

We decided that a more consistent approach to information gathering was also needed. My husband suggested that as part of the monthly steps we take to balance our bank statements, we would record and file the activity shown on the statement that would ultimately be needed at tax time.

If we sent a check to United Way or deposited funds to our checking account that was withdrawn from our IRA, we would make copies of the transactions and file them in the appropriate file folder for future reference. Sure, it took a few extra minutes each month, but it has saved us so much time in the long run because we do it when the activity is fresh on our minds and we remember “why” we did what we did and how it might affect our taxes later.

One thing to remember is that each state is different, so the items you save for review might be needed to not only complete your Federal Income Taxes but also the state of residence if there is an income tax in your state. Also, some states may allow certain deductions where others won’t.

I’m not a tax expert and can’t provide specific tax advice, that is between you and your accountant. Be sure to ask questions as they come up, don’t wait until later when it may be too late to make changes in how you approach purchases or record income.

Another thing we did years ago was to purchase a good bookkeeping program we could run on our computer. There are many choices, but we decided on QuickBooks. My husband has a good grasp of accounting concepts and used those to set up his “chart of accounts” as if we were running a small business.

When we spent money or received funds from various sources we would enter the information in our QuickBooks program and assign the activity to the appropriate account. This not only helped us throughout the year to be prepared for tax time to come, but it actually helped us monitor our budget on an ongoing basis to make sure we stayed on track. A great feature of this type of software is that you can print off reports for your accountant as needed, or the full file can be sent if desired.

Another tool to consider, although not used by me, is a program like TurboTax. This type of program is a great time saver and one that can help you stay on track with the actual tax computation and filing. The program may also prompt you to think of both income and expense items that should be considered. We have daughters who think Turbo Tax is the best investment ever.

When we are ready to provide income and expense information to our CPA for possible quarterly estimated tax reporting, we are ready in minutes because of the organizational steps we have done for years. Here is a list of file labels you may want to consider for your tax time efforts:

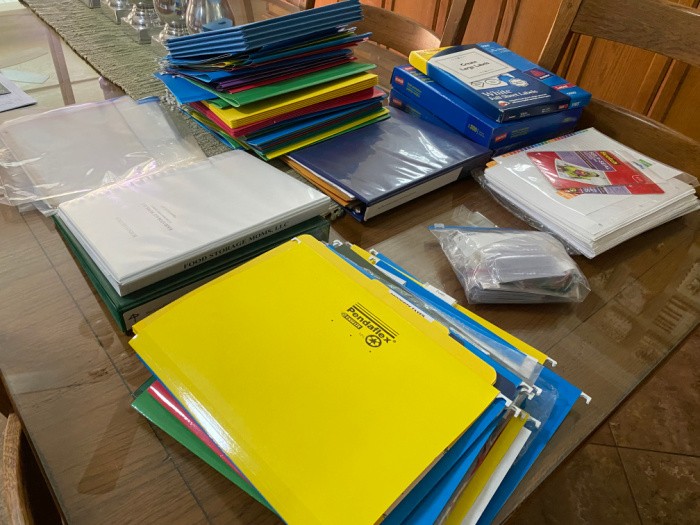

I use the Avery brand address label #5160 and affix them to folders that are actually hanging pockets. These are the two things I use:

Avery Easy Peel White Mailing Labels for Laser Printers, 1 x 2.62 Inch, Box of 3000 Labels (5160)

Avery Easy Peel Address Labels for Inkjet Printers, 1 x 2.62 Inch, Box of 750 Labels, White (08160)

Labels to Consider For Tax Time

1099’s and copies of checks to reconcile (Note: if you have to send out, or you may receive 1099 forms for Non-Employee Compensation, the new form is a 1099-NEC rather than 1099-MISC)

1098’s

W-2’s

K-1’s

IRA or other Retirement Account Deposit or Withdrawal/Distribution Information

Real Estate Property Tax Notices from the County

Car and Other Personal Property Taxes from the State or County

1031 Exchange Information

Hud Settlement Sheets from home purchases or sales

Notices received regarding capital gains and/or losses

Funds spent on medical and dental procedures, including prescriptions

Information relating to catastrophic losses

Purchases that may qualify for tax credits, such as efficient appliances and possibly cars

Gifts that may qualify under certain rules when given to family members

Unemployment compensation received

Certain educational expenses or funds set aside under a 529 or other plans

Business expenses, food, supplies, advertising, gifts, shipping expenses, if applicable to your small business

Charity contributions

Final Word

When it comes to learning how to be ready for tax time next year, I hope I’ve given you some quality tips based on personal experience. It seems like the forms, regulations, policies, and laws approved by Congress and local legislatures tend to change from year to year. Having a professional prepare your taxes may seem expensive, but it could save you money in the long run.

Take the time to work on your tax prep as the year progresses so you don’t get swamped at yearend or right before tax time itself. If you set aside an hour or two each month, that could possibly be enough to make a real difference. If you have questions you can reach out to the IRS, but I’ve found that is a little cumbersome, so find a good accountant, someone other than your “cousin Vinny.” lol

Good luck, and stay organized as all preppers do. May God Bless this world, Linda

Linda,

I’ve just begun assembling the papers I need to do my taxes this year. For the past two years Jane and I would not have had to file if I hadn’t sold some stocks. And this year for the first time I’ll be required to take a minimum distribution from my IRA so I’ll have to file next year as well. It’s certainly an inconvenience as I don’t anticipate having to pay anything, but such is life. I’ve been a professional procrastinator when it comes to filing in past years but this year I’ll buckle down and get everything organized so my accountant can get them filed by next month.

Your advice on keeping good records and doing so monthly is excellent.

Hi Ray, thank you for your kind words, my friend. I remember working at a bank with high-end clients and they had no clue how to “file” things. I had about 200 clients and half of them I made a filing system for them if they wanted one. They don’t teach how to organize your paperwork in high school or college. It was a blessing for my clients and for me when I needed that paperwork from them. Life has taught all so many skills when we needed them. Linda