8 Things You Probably Didn’t Know About a Budget

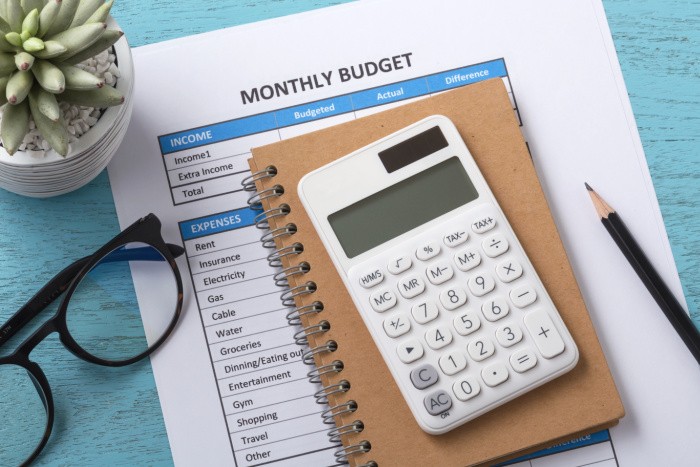

Today I want to share 8 things you probably didn’t know about a budget. Are you someone who struggles with your finances? Whether it’s because you spend your money on things that you don’t need, you have a job that doesn’t pay as much as needed with the higher cost of living right now, or you simply don’t have a good strategy for saving money, a budget can help put some of these financial woes to rest.

After all, you want the best for your family and probably don’t want to end up working past the normal retirement age. We also have rising costs we have no control over, so we must budget now more than ever before, right?

But without a plan, living pay check to pay check for years to come may be exactly what you’ll have to look forward to. I’d like to share some valuable tips that I’ve learned along the way to help put you on track. These are several things that you may not have thought about when it comes to budgeting.

8 Things You Probably Didn’t Know About a Budget

Items I Highly Recommend

- Cash Envelopes

- Calculator with Printable Paper (yes, I’m old-fashioned)

8 Things You Probably Didn’t Know about a Budget

1. Not Every Budgeting Method is Right for Everyone

There are several different budgeting methods out there that you can use to keep track of your spending. But what you may not have known, is that not all of them are right for everyone because each of us is wired differently. A few of these methods include the checkbook method, the envelope method, and the 50/30/20 rule.

That rule is one that states you should spend 50% of your after-tax income on actual needs, 30% on wants or discretionary spending, and 20% on savings or safe investments that will earn you additional income. You’ll need to experiment with each one to see which is the best fit for you and your family.

2. Budgets are Not Set in Stone

Contrary to what you may have been led to believe, a budget doesn’t necessarily stay the same for every month of the year. In fact, your budget could be a constantly changing document that reflects your financial situation at different times of the year, particularly if you are on a sales commission that fluctuates as the seasons change. This means that if you have a change in income or expenses, your budget should be updated or adjusted to reflect these changes.

That’s why financial advisors will tell you to sit down with your spouse or partner at least one time a month to go over what some of these changes may be. It’s also a time where you can reflect on other expenses that your family would be willing to give up or you anticipate having to incur, like car repairs or pending surgery.

3. A Budget Helps You Enjoy What You’ve Earned

Believe it or not, budgeting actually helps you enjoy your money more than those who spend their money aimlessly. Wondering how that could possibly be? Well, when you have a budget, you’re mindful of every purchase you make.

So, when you do spend money, you know that it’s going towards something that matters to you. That could be something you really need, like a new pair of shoes, or something that will bring you and your family some joy, like a weekend getaway. This makes your spending more purposeful and satisfying in the long run.

By sticking to a budget, you’ll also end up with more money in your savings that can then be used on a bigger purchase later on down the road and keep you from reaching for a credit card every time an emergency pops up.

4. Budgets Can Help You Save Money

As I already mentioned, budgets can help you and your family save money for the future. But how exactly does that work? Well, when you have a budget, you’re aware of your current income and expenses. This allows you to make adjustments to ensure that you’re not spending more than you’re bringing in each month.

If you find that you are spending more than you’re earning, a budget can help you figure out where to cut back so that you can start saving money each month. For example, you may need to cut back on your entertainment budget, or the number of times you eat out, so that you can have more money to put towards savings.

Sadly, it could show that expenses are what they are, so you’ll need to look at new or additional income sources. Depending on your age and future plans, it could also mean making the decision to move to a less costly location, or downsizing so the monthly costs of rent or your mortgage payment can be reduced.

5. Budgets Give You a Sense of Financial Security

When you have a budget, it can help give you a sense of financial security. This is because you’re always aware of your current financial situation and where your money is going. This can help put your mind at ease in case of an emergency and help you sleep better at night knowing that you’re not spending more than you can afford. Who would say no to this?

6. Budgets Can Help You Reach Your Financial Goals

There’s an old saying that goes, “if you fail to plan, you plan to fail.” We all have visions of how things can be, so budgets can help you reach your financial goals and dreams. This is because budgets give you a road map to follow in order to reach your desired destination. For example, if you have a goal to save up for a down payment on a house, a budget can help you figure out how much you need to save each month in order to reach that goal within your desired timeframe.

If you have a budget and stick to it, hopefully, you’ll be able to retire comfortably instead of worrying about whether social security will still be there when you’re ready to do so. How to Save Time and Money with Grocery Shopping

7. It’s Not Just About Money

When you’re creating a budget, it’s important to keep in mind that it’s not just about money. Your budget should also account for your time, energy, and resources. This means that you’ll need to factor in things like how much time you’re willing to spend on work each week and how much energy you’re willing to expend on tasks that need to be completed. This will help you to look at these situations differently and possibly make some changes in how you do things. Again, for some that could include going back to school to learn a new trade or get a degree.

If you find that all you are doing is working, it may be time to refocus and find a different line of work, or go to work for a different employer or industry. Yes, these are tough decisions, but the earlier in your career you’re willing to make those choices, the happier you’ll be. 11 Foods To Buy On A Cheap Budget

8. You’re Not Perfect and That’s Okay

When it comes to budgeting, you’re not going to be perfect 100% of the time. In fact, most people aren’t and that’s perfectly okay. The important thing is that you’re making a conscious effort to be more mindful of your spending and are working towards a better financial future. So don’t beat yourself up when you make a financial mistake because it is bound to happen at some point. The important thing is that you learn from these decisions and avoid doing them again.

Since I spend so much of my time trying to help my readers be better prepared, I’m hearing all the time about challenges people are having to face, many of which they have little or no control over. It could be a cut back in hours are work, or being totally laid off. It could be a health issue based on an accident, or you or a family member may become sick. Again, if your budget has a provision for setting funds aside in savings as an emergency fund, you’ll be better prepared for these unexpected situations.

8 Things You Probably Didn’t Know About a Budget

Final Word

Budgeting is a wonderful tool that every family like yours should consider using. By sticking to a budget, you’ll have more peace of mind when you rest your head on the pillow, and you’ll also have a brighter future to look forward to. Can you think of any other tips about budgeting that you’d be willing to share with others? I’d love to hear your thoughts. May God Bless this world, Linda

Copyright Images: Budget Concept AdobeStock_234832250 by thanksforbuying

Linda,

One of your best articles ever. Though I have always lived within my means I’ve never been great at budgeting. I think that’s mostly because my wife and I always made decent salaries when we were working so money was never a huge issue. The fact we’ve been Prepping for decades helped us to save money also. But you are right that budgeting is about more than just money. I have to budget time for gardening, pet care, household tasks, taking care of Jane when she’s ill, writing, and on, and on.

For the past seven years, since we retired, I been more conscious about budgeting our finances. One method I use is to charge virtually all purchases on one or two credit cards. (They get paid off in full every month). Their annual itemized lists of expenses shows me at a glance how much I’ve spent on any given category and allows me to quickly target which expenses I can cut back on for the following year. And keeping an eye on the monthly statements helps me do the same throughout the year. I do not recommend this method for anyone who can’t pay off their cards in full every month, but it works well for me.

Hi Ray, thank you for your kind words, my friend. Life does change when we retire, that’s for sure. Luckily for you and me prepping has always been a way of life for us. It’s hard to start buying everything you need to survive all at once. We have accumulated our preps over many many years. Here’s the deal, I look at the prices of the items I have purchased over the years, and wow, have they gone up in price. But, I can’t see anything coming down in price, not at all. If someone needs anything, please check the thrift stores and garage sales. I like your idea of using a credit card and paying it off each month. Love it! Linda

I’ve read all sorts of budgeting methods but the one that works best for us is a spreadsheet in Excel. I list all the monthly bills at the top, annual bills at the bottom. I know what’s coming each month and I check them off as I pay them the first of the month and check the date. I do equal payments with the utilities which keeps it consistent. I know what’s coming for the annual payments and save for them. I also use only one or two credit cards which get paid off in full each month. I have a very bad “fabric habit” that will have to get curtailed when my husband completely retires but I believe I have enough in my stash to keep me busy for years…as long as I don’t go to the fabric stores and stay offline. One can dream, right?

HI Robbie, oh fabric, I love fabric stashes! We have to use what works for us, and you have a great system. I love using equal pay as well, I do not like surprises! Life is so good when we know where our money is going. Linda

Since my husband had his first major heart attack when he was 32, I assumed responsibility for our finances to spare him the stress. I always gave him a net worth statement every 6 months. We worked very hard and put 4 children thru college. I wouldn’t say retirement has been easy the last 15 years, but we are comfortable. You are very wise Linda, a budget, along with a firm hand on the finances is critical. There is a big difference between need and want. Stay safe and healthy everyone.

Hi Chris, oh my gosh, that is so young for a heart attack! I agree, there is a big difference between need and want. Let’s all stay safe and healthy, thank you! Linda

Great article! Budgeting and using the budget that is best for you, is so important for so many reasons. A good budget has your money working for you. When every dollar brought into the finances has a “job”, then things work easiest. When we were first married, my husband was a college student and I had just finished grad school. Money was very tight. Then it got better and over about 5 years, we got out of the habit of budgeting.

Suddenly we were deeply in debt and our medical bills (mostly mine) and credit cards (mostly from charging medial things) were 200% of our mortgage. It was very scary and even scarier, we didn’t realize that we were headed that way. We went back to budgeting and created a zero based budget, where every dollar was accounted for, a “Snowball” debt reduction list (smallest debt paid off first, then that money goes to next debt and so forth) and most importantly we started “saving funds” which are things that will happen and will cost money and you need to be prepared for. Things like annual property tax on cars, we pay about $350, so we put $7 in cash in the savings envelope for property tax. We have these savings envelopes for all the major things like groceries and car repairs. And for the minor ones that are important to us like gift giving, cat expenses and a $5/week one for me to spoil our granddaughter.

The system works for us and while it took 7 years to be debt free, we have been debt free except our mortgage for 10 years. If we hadn’t had to move out of our split level house after I fell and injured my leg, we would have been mortgage free in 2023. I was injured in 2016 and we moved in 2017. Hopefully we’ll have the new mortgage paid off by 2030.It’s more difficult in retirement to pay extra.

Hi Topaz, congratulations on everything you have accomplished!! Wow, you are amazing, good job! It does take an effort but once you start you “get it” and it feels so good. Of course, we may have hiccups like your injured leg and having to move, but you are doing great! I love the envelope practice, it works for me as well. 2030 to have your mortgage paid off is AWESOME!! I love your comment, thank you for sharing. Linda

Great article! I just wanted to mention budgeting time and money for tithes, charities, and charity events like The American Cancer Society Run/Walk Relay for Life or any charity that is important to you or your family. Budgeting time and money for others is a gift that we give our souls.

Hi Ravenna, oh my gosh, you are right! My husband and I are deeply involved in the community with “The Exchange Club”. We help the boys and girls clubs, battered women, and children. The list goes on and on. It’s a blessing for our soul, you are so right, my friend. Linda.